The Lawyer's Lawyer

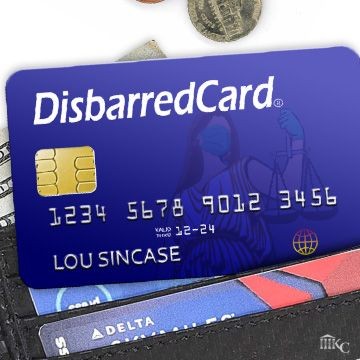

What's In Your Wallet?

Q. Unable to take payments in person these days, I may let clients use apps like Paypal and Venmo to pay fees and retainers online. Are such payments allowed?

A. Using these apps to pay fees that you have already earned doesn't trouble me. But taking retainers through Paypal, Venmo or an ordinary credit card does.

Rather than place unearned fees into your attorney trust account, services like Paypal and Venmo transfer the funds to your personal or business account with that vendor and take a small percentage to cover processing. This is no different than placing unearned fees directly into a personal or business bank account. Bypassing regulations designed to protect client deposits, you are commingling your own funds with those you have yet to earn.

The Rules of Professional Conduct require that you protect all client funds by placing them in an attorney trust account. There is no exception for Paypal, Venmo or any other online service. Nor is there any grace period provided to those who would subsequently transfer funds into escrow. Once funds are placed in your name, and not in an attorney trust account, you will be held in breach of your ethical duty to safeguard client funds.

Even if you have funds deposited directly into your trust account, you will undoubtedly encounter difficulty with Paypal, Venmo or ordinary credit cards. All of these services deduct processing fees from the client's payment, as well as fees for any rescinded transactions or "chargebacks." As these are business expenses which your firm should pay, you mustn't take them from client funds in your trust account.

Some would say that you could leave funds of your own in the trust account to cover these fees. I wouldn't. Although there are rules that may let an attorney deposit funds to cover certain banking fees, service charges, or minimum balance requirements, they might not extend to third party processing fees. Even if they did, depositing extra money in your trust account may make it difficult to reconcile, leave you prone to overdrafts, and cause you to lose control of the account. This gray area may also prompt accusations that you are improperly commingling your funds with those of your clients.

To prevent these violations, you should use a service like LawPay or LexCharge. Specifically geared toward lawyers, these services will deposit the full amount of a client's retainer into escrow, but will take transaction fees from the attorney's operating account. This eliminates any commingling of funds, ensures that retainers go directly into escrow, and prevents your clients from paying fees that should be borne by your firm.

If you don't have enough business to justify the setup or maintenance fees for one of these services, you should only use the more popular payment apps to receive fees which you have already earned.