The Lawyer's Lawyer

Ten Commandments of Trust

Q. As the new managing partner of our firm, I have no idea how to manage our trust account. What must I do to comply with the rules?

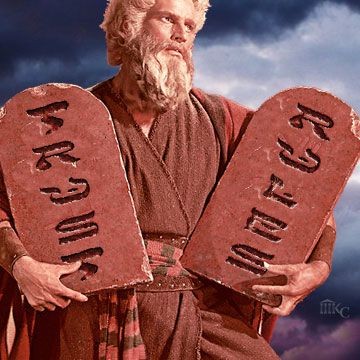

A. With little more detail than that offered in the Ten Commandments, law school ethics professors taught us that "Thou Shalt Not Steal" from our clients.

But protecting client funds is more complicated than that. Without proper maintenance and record-keeping, honest lawyers can quickly lose control over their client trust accounts, violate the Rules of Professional Conduct and face serious sanctions.

Meeting our ethical obligations takes more than "good character." It takes work.

This is a daily exercise. Every deposit and every disbursement must be documented. Every deposit slip and check must be copied or otherwise maintained electronically through properly configured accounting software.

It's a lot easier with the right software. But with or without a computer, you must keep ledgers of all transactions, both for the account as a whole and for each matter involving trust transactions. Rather than relying on your bank, you must check its monthly statement for errors, inspect copies of your canceled checks, and reconcile the bank's balance with your own ledgers each and every month.

The nuances of trust accounting can fill an entire course. But our Ten Commandments of Trust, together with this short video, review the basics that Moses, and your law school ethics professor, glossed over: