The Lawyer's Lawyer

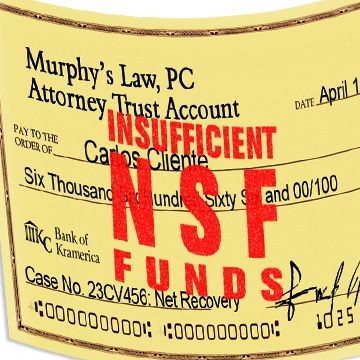

The Dreaded Overdraft

Q. I'm ashamed to admit that I don't know how to balance my own checkbook. Knowing that banks are reporting overdrafts to the grievance board, I'm terrified of bouncing a check on my trust account. May I keep some extra money in the account just to be safe?

A. No. That approach would be "insufficient" ... and unethical.

You may fail to reconcile your own personal accounts, but you can't approach client funds the same way. As a fiduciary, you must manage your attorney trust account quite carefully to comply with the Rules of Professional Conduct.

Although some states will let you deposit your own funds into the account to cover fees, service charges, or minimum balance requirements, most banks waive fees and balance requirements on attorney trust accounts. No one lets you keep your own funds in the account to serve as a "cushion" against overdrafts.

Under Rule 1.15(a), "An attorney shall hold property of clients or third persons that is in an attorney's possession in connection with a representation separate from the attorney's own property." If you commingle your own money with client funds held in trust, you cannot keep the funds separate as the rules require. So, no, you may not deposit your own money into the trust account to keep checks from bouncing.

Some lawyers try to accomplish the same thing by leaving earned fees in the account and taking extra time to withdraw them. For example, if a case settles for $300,000, the lawyer may leave his $100,000 contingency fee in the account long after disbursing the balance of the recovery to the client and to lien holders. Some lawyers will even draw these funds down over an extended period so that their trust accounts reflect higher balances than needed to cover other transactions. These strategies are just as bad as depositing your own funds into the account directly. Once you've earned the fee, your failure to withdraw it promptly amounts to commingling as well.

Overdrafts resulting from innocent mistakes are easy enough to explain. But once notified of an overdraft, Bar Counsel will want you to produce a few months of trust account records to check for other improprieties. If these records show commingling, checks made payable to "cash," or other questionable withdrawals, these irregularities may place your license at risk.

That's why leaving extra money in the account or similar tricks are no substitute for careful monitoring and record keeping. The rules require you to reconcile your trust account and to maintain monthly ledgers accounting for every penny. That's the only proper way to prevent the dreaded overdraft notice and to survive the audit which follows it.